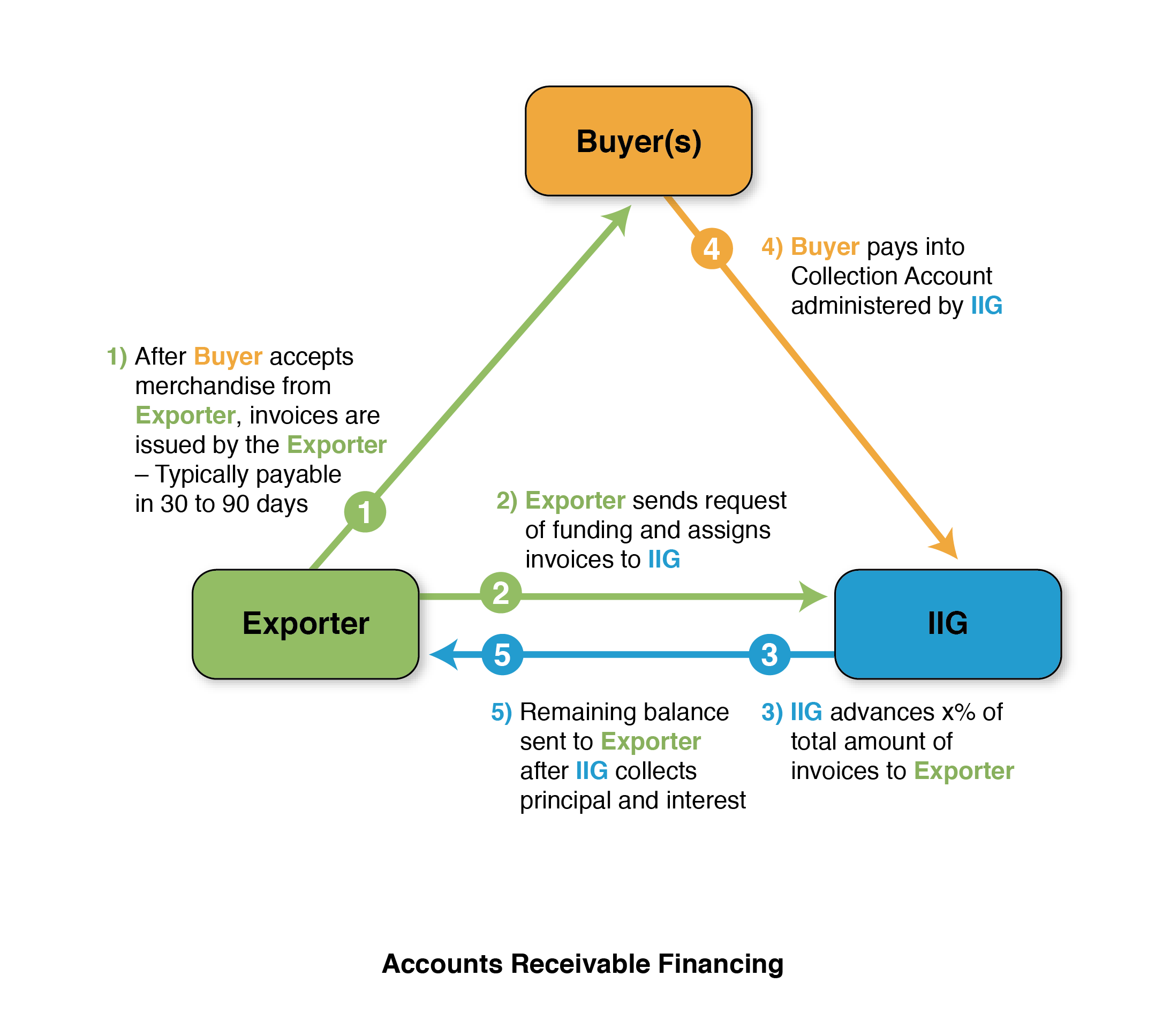

Accounts Receivable Financing

Under accounts receivable financing, a company obtains a short-term credit facility using its accounts receivables as collateral. The business remains responsible for collecting on its accounts receivables. Examples include factoring and forfaiting transactions.

EXAMPLE: Accounts Receivable Financing

A company that specializes in the processing and trading of sesame seeds approached IIG to finance its sales in the U.S. and Japan. After thorough due diligence, the firm extended a revolving facility to this client.

- IIG only made advances against preapproved off takers to whom a notification letter (document in which the off takers agree to pay into the collection account) was sent and acknowledged.

- IIG made cash advances to the borrower against a percentage of the final commercial invoice and bill of lading ("B/L").

- IIG was repaid at the maturity of each individual transaction. All payments flowed through the collection account controlled by the firm in accordance with the terms defined in the invoice.

- The maximum payment term for each transaction was 60 days from B/L date.

- Funds repaid could be re-borrowed depending on the availability under the revolving credit facility.