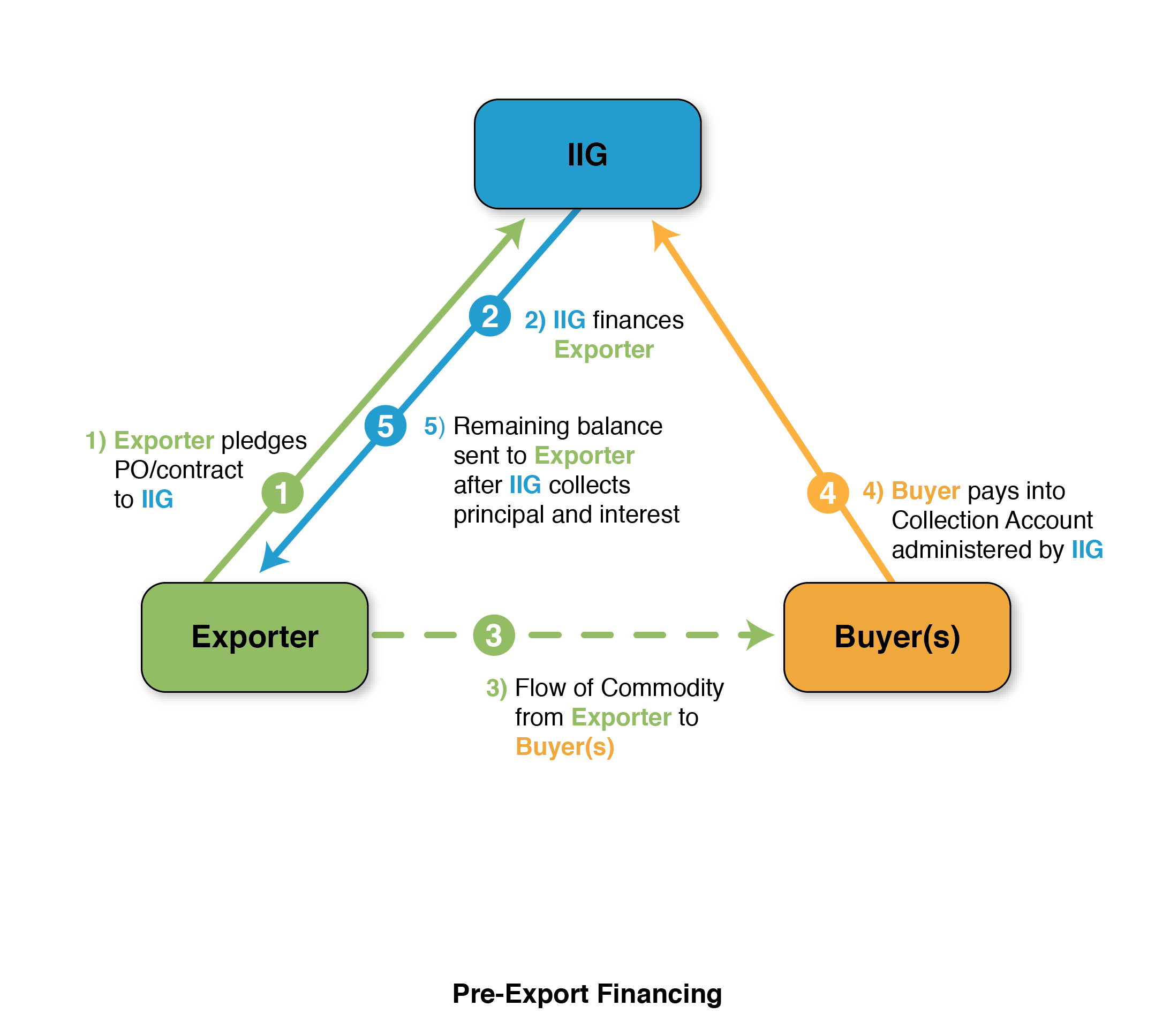

Pre-Export Financing

Under purchase order, or pre-export, financing, a borrower obtains funding based on confirmed purchase orders or contracts from approved off-takers ("contract") or projected proceeds from specific off-takers ("future flows").

EXAMPLE: Pre-Export Financing

IIG extended a facility to a producer of fruit.

- The Firm identified the company's long-term contracts were with reputable off takers worldwide and that the crop production risk was mitigated by the farms being located in two different Latin American countries.

- IIG extended a three-year purchase order financing facility guaranteed with the underlying contracts. The facility was to be repaid in 36 equal monthly installments.

- Due to the constant cash collections from the off takers, the loan balance was replenished and new facilities were created numerous times, contributing to a robust client relationship that produced consistent returns for IIG while simultaneously supporting crop production in an emerging market.