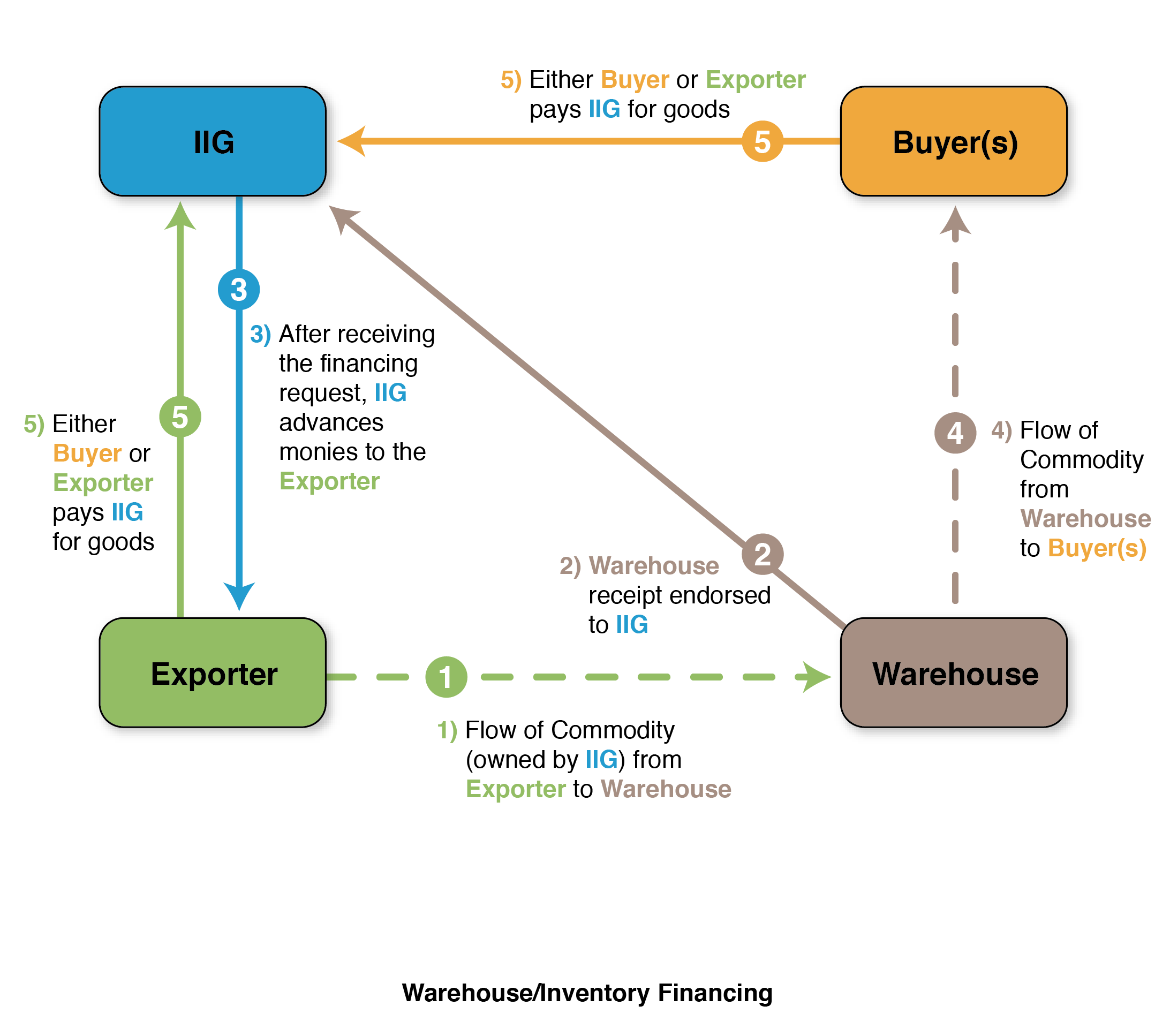

Warehouse / Inventory Financing

For qualifying commodities and products, IIG structures flexible warehouse and inventory financing facilities to accommodate transaction flows. By using securely stored goods as collateral, borrowers can obtain financing by depositing the inventory in either a qualified third-party warehouse or their own warehouse, both of which are managed by a collateral manager as well as IIG.

EXAMPLE: Warehouse Inventory Financing

A South American processor and exporter of nuts sought to finance its exports to major US based food service companies and obtained financing from IIG by pledging inventory of raw and processed nuts.

- IIG extended a facility which was repaid in 11 equal monthly installments with a bullet payment at the end of month 12; payments were received through assigned contracts from acceptable off takers.

- The inventory pledged to IIG was stored in a certified warehouse, monitored by a reputable third party collateral management company, and released only when IIG was repaid directly by the off takers.

- IIG was issued monthly inventory inspection certificates by the collateral management company to ensure that the facility was fully collateralized.