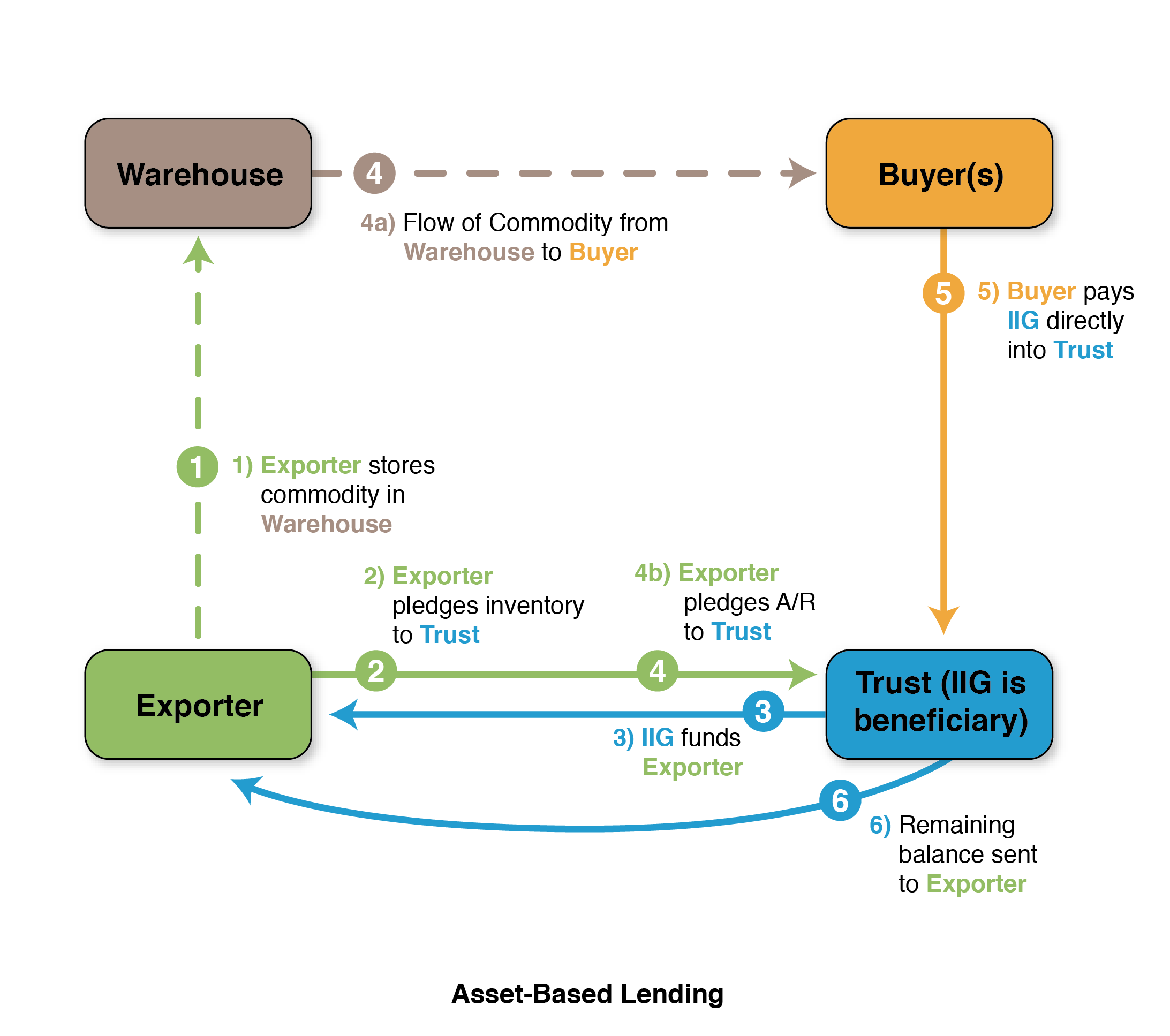

Asset-Based Lending

Asset-based lending is a specialized type of financing whereby the borrower obtains funding utilizing specific assets as collateral (Inventory) and delivers to an assigned off-taker (A/R). Credit limits are primarily based on the value of the borrower's pledged assets (as opposed to revenues and profits) and LTV haircuts

are applied for risk mitigation.

EXAMPLE: Asset-Based Lending

A seafood processor and exporter pledged its inventory and accounts receivable (A/R) to obtain a credit facility from IIG to finance the complete cycle from processing to exports.

- The first stage of the financing is secured by inventory in the form of raw material and/or processed seafood. The inventory is stored in a warehouse controlled by a reputable international collateral management company and a trust to administer the process. IIG is the primary beneficiary of the trust.

- During the second stage, a security interest is granted to IIG for all A/R held by the trust. All invoices are confirmed by the off taker directly to IIG.

- The borrower issues a borrowing base certificate (the "BBC") detailing the loan balance and the amount of collateral held in inventory and A/R, prior to each request of disbursement.

- The off takers pay into a collection account in the name of the borrower held in the USA, but controlled by the Firm.